The 2022 retail market is tough. Costs are rocketing due to political, economic and health crises. Supply chains are under pressure as a result of shipping and haulage issues.

COGS has rocketed and retailers are understandably looking to inflate prices whilst protecting margin and maintaining customers’ value perception.

This is the time for retailers to make intelligent pricing decisions. Frameworks should find the optimum price that’s in line with the competition, whilst keeping in mind sensitivity and elasticity.

It’s also the moment for innovation. The retail media era has begun and it’s the perfect opportunity for retailers to diversify income.

Standing on the shoulders of giants.

Amazon’s retail media business was worth $24 billion in 2021. That figure’s expected to rise to over $30 billion in 2022.

Meanwhile, Walmart sold $2.1 billion in ads last year via Walmart Connect. The likes of Best Buy and Kroger are also investing in their own networks.

Retail media is growing – and fast. eMarketer is forecasting exponential growth in retail media networks within the next couple of years.

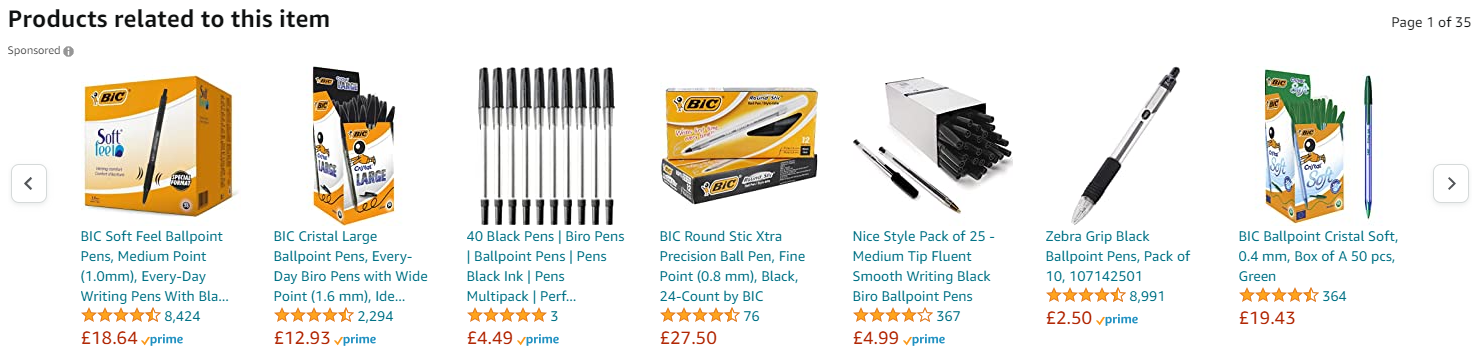

But let’s wind it back. If you’re unfamiliar with the term, ‘retail media’ can be defined as advertising within a retailer’s digital properties – including websites, apps and in store digital displays/signage. The brands and products advertised are for sale in their online and/or physical stores.

Retail media may appear in the form of native or display ads throughout the customer journey – on homepages, search pages, category pages and product detail pages.

It’s particularly beneficial for multi brand retailers with lots of first party data.

Image: display advert on a product detail page for a Bic ballpoint pen on amazon.co.uk.

Let’s get this party started.

If you’re a marketer, you’ll have no doubt heard third party data is (almost) dead. As a result, digital advertising relying on this kind of data will be harder to track, rendering it far less effective.

It’s therefore more important than ever for retailers and brands to collect first party data to inform commercial decisions. First party data includes demographics, purchase history, website/app activity (eg page views, abandoned baskets), email engagement and customer reviews.

Retail media is an opportunity for retailers to claw back revenue from the diminishing margins of digital sales. It also provides scope for retailers to enhance relationships with the brands they stock – increasing awareness, driving sales, and offering greater access to customers.

Success lies in creating value.

To develop a successful retail media network, retailers need to create value for both their customers and their partner brands.

For customers, value lies in personalisation and smooth user experiences.

For partner brands, value could be in the form of customer insight (plugging the gap left by changes to third party data) and closed-loop ad measurement. Reporting on ROI and other distinct KPIs clearly demonstrates the value of any advertising, fuelling growth for both the retail media network and the partner brand.

Customer insight drives intelligent targeting.

As a retailer, you need to know your customers.

But we don’t just mean your buyer personas, Average Joe and Core Range Chloe. We mean understanding real customers on an individual basis.

Retail media is an opportunity to make use of and build on your first party data. This kind of data can drive future supply chain decisions (eg buying, assortment) and marketing decisions (eg segmentation, customer journey optimisation and loyalty).

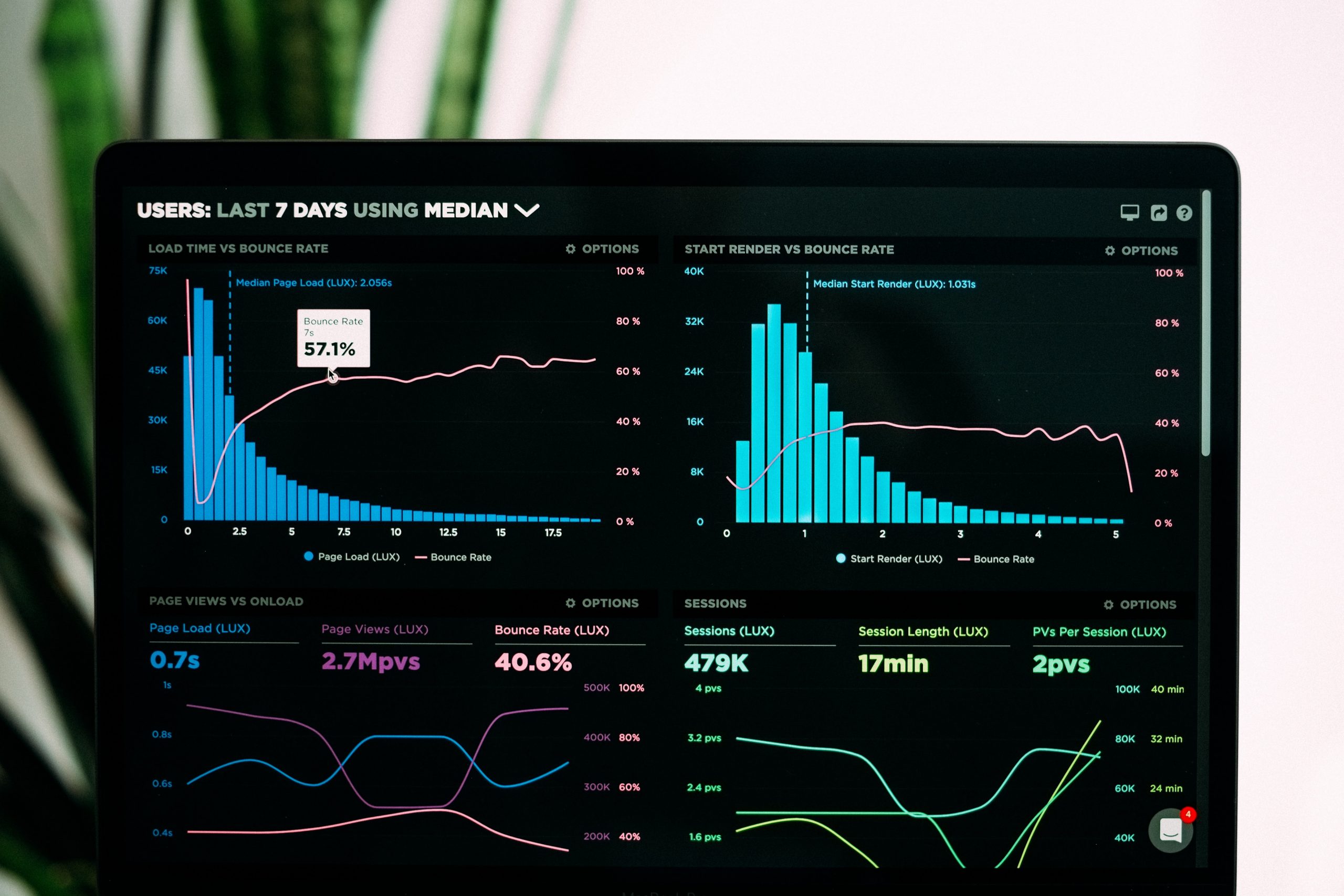

To excel in the retail media space, retailers need to take the swathes of data they collect every day and turn it into actionable insight. This is where data and analytics can help – decision intelligence uses data science and AI to help retailers identify these actions.

This could be in the form of segmenting customers and creating targeted audiences. It could also take the form of measuring the success of campaigns to inform future investment, supply chain decisions or product development.

Ultimately though, any advertising needs to be relevant for customers.

It all comes back to affinity analytics.

No one wants their shopping experience to be hampered by irrelevant, annoying adverts.

We harp on about it a lot, but affinity analytics is the key to effective, personalised retail media.

Affinity analytics is a data science technique that uncovers deep relationships – between customers and products; customers and other customers; and products and other products.

In combination with attributes (how you describe products, customers or their relationships) and customer need states (how customers make shopping decisions), affinity analytics can help retailers provide shopping and advertising experiences tailored to individuals, based on their browsing and buying behaviour. For example, if a customer is browsing your site having very recently bought a pair of jeans, effective advertising would display the next logical purchase (a belt, for instance) rather than more similar pairs of jeans.

In the retail media world, using your first party data to add value and deeply understand consumer behaviour is the key to success.

Sign up to our mailing list to read more articles like this.